The best type of insurance for millennials is universal whole life insurance, also known as UL. What exactly is UL? Well, it's an insurance product that has two main features - a savings component and low rates. Making this the perfect choice for today's high-tech era in which goods are regularly replaced with new versions at far less cost.

Why are Millennials interested in investing?

Millennials whose best type of insurance is universal whole life insurance are turning their sights on investment-inspired lifestyles. As more Millennials enter the job market, they spend less years (potentially decades) working trying to reach retirement and are gaining more control over their investments. As most Millennials in the workforce have contributed upward of $25,000 by as early as their 20's, they have a greater need for a constant stream of income.

Who uses the UL insurance for Millennials?

People who are making their buying decisions will want to consider this life insurance offer, but is UL insurance the best option? Finding out what other employers are looking for when selecting an insurance plan may be a good idea. The UL insurance offers the best support with reward plans for millennials. Even after you reach a certain age milestone, your younger self remains young and attractive at their anniversary to keep up with rewards. For example, if you are 60 and insured under the UL insurance, your 30-year-old self will be ready as a 25-year-old to take over $2,500 of benefits after they've reached 65 (includes health, vision and dental).

Read- How can Fixed Deposits Help Senior Citizens in their Financial Well-Being?

Five reasons to buy Term life insurance

For each 1 sentence below, explain what makes it the best argument:

-Term life insurance is cheaper.

-Term life insurance is portable and renewable.

-Term life insurance is more flexible than most other forms of insurance.

-Term life insurance provides protection for major life changes such as a death or disability.

-Term life insurance provides protection in case something happens to your healthcare provider.

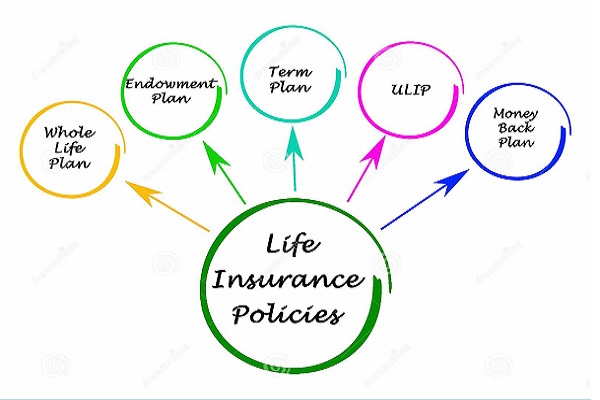

Things to consider when buying Life Insurance

The millennial generation is not in the best financial situation and purchasing a life insurance plan is an important part of their long-term financial planning. Millennials often buy individual policies rather than group plans, but each party should be careful of what they're getting into. The median income for millennials decreased from $35,000 to $33,000 compared to the previous generation's median income of $38,860.

Things to consider when investing in UL

Since millennials have a "generational imperative" to move into their households, they also must consider the type of life insurance they will need to cover them in case of an unfortunate death. Investing in UL is all about determining whether you and your family's needs will be met. You need to take a deep breath, know what you really want, and determine how easily you'll be able to secure UL down the road should you decide to buy on the market.

Conclusion

Preparing for the future is important. One way to do this is finding a life insurance plan that best suits your needs. Millennials are going to have a tough time getting life insurance, but if you make it through the process successfully, you will be able to solidify your financial plans. The best way to find a good policy is to check on the internet and then compare online against what is available in-store.

No comments:

Post a Comment